Unleashing the Power of Dividend Reinvestment Plans

What is a Dividend Reinvestment Plan (DRIP)?

A dividend reinvestment plan (DRIP) is a program that allows investors to reinvest their cash dividends into additional shares or fractional shares of the underlying stock on the dividend payment date. Although the term can apply to any automatic reinvestment arrangement set up through a brokerage or investment company, it generally refers to a formal program offered by a publicly traded corporation to existing shareholders. Around 650 companies and 500 closed-end funds currently do so. – Definition courtesy of www.investopedia.com.

Understanding Dividend Reinvestment Plans

To make it as simple as I can, the way it works is when a company pays you a dividend, and you can use that dividend to buy more shares or fractional shares if you didn’t make enough from that stock yet. Most brokerage firms have an automatic feature to do this for you. I prefer to do it manually as a dividend from one company might go towards me buying a share of a different one.

This is an amazing thing because overtime the money you put in will double or triple in value because of all the reinvesting you are doing. For example, let us say over the course of 20 years you invest $200,000. This is straight cash, nothing else. With the reinvestments, your total stock value could be $400,000. Not saying everyone will double their money but it is a possibility.

Benefits of Dividend Reinvestment Plans

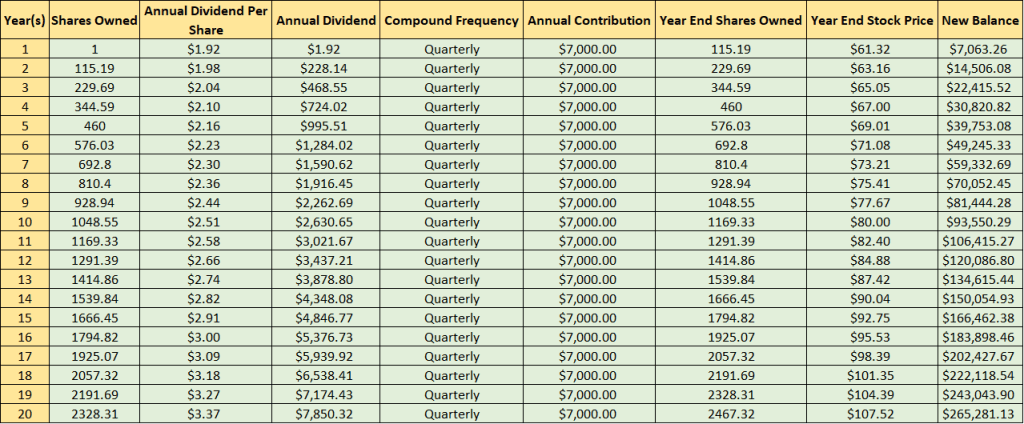

Check out this example. For this one, will use the famous brand Coca-Cola (KO). This example uses a Roth IRA with $7,000 year contribution with 10% annual interest, and 3% share price and dividend yield increases. With just $583 a month in KO over 20 years, you would have a portfolio value of $265,281.13. This portfolio would give you $8,672.93 a year in dividend income.

Cost-Efficiency and Long-Term Growth

DRIP method is a cost effective way to reinvest your money. By using the dividends you earn to buy more shares, you save on money that you would normally have to put in. For example, let us say you buy 1 share every paycheck. You have earned enough to buy a share with your dividends. Now, when the dividends hit you nab a share. This did not come from your paycheck.

Another way to look at it let us say with the 1 share a paycheck example, you put in roughly 52 shares a year. Every quarter you own enough of Coca-Cola to grab 1 share. Now, you gain 4 additional shares a year making your total 56 a year. Every year this goes on will increase how many shares you own. You paid for 52 but gained 56. Cost Efficient.

The Flexibility of Dividend Reinvestment Plans

One of my favorite things about this is the fact I can use my dividends how I want. A lot of people have the automatic feature set so they put their dividends toward the stock that gave it to them. I however love the manual approach because I might take dividends earn from Coca-Cola and use it to buy Pepsico. A stock in your portfolio might be at a good price so using your dividends to nab that stock instead is a huge benefit.

The flexibility this option gives investors is crazy. A lot of people forget about this when they consider investing. They see the market as something you buy and sell daily to make money. When in reality you can buy a stock and hold it forever and create a passive income from it. A long-term mindset is crucial for a Dividend Reinvestment Plan to work.