A Look At My Portfolio January 2024

My portfolio for January 2024 is looking good. I have $7.43 in dividends for the month. Not bad, but I did not add as much as I wanted in January. I will make it up in February. I plan to increase my contributions to my Roth IRA to $200 in February with a goal of $583 by July. I will most likely max out my IRA near the end of the year as I will have extra income then.

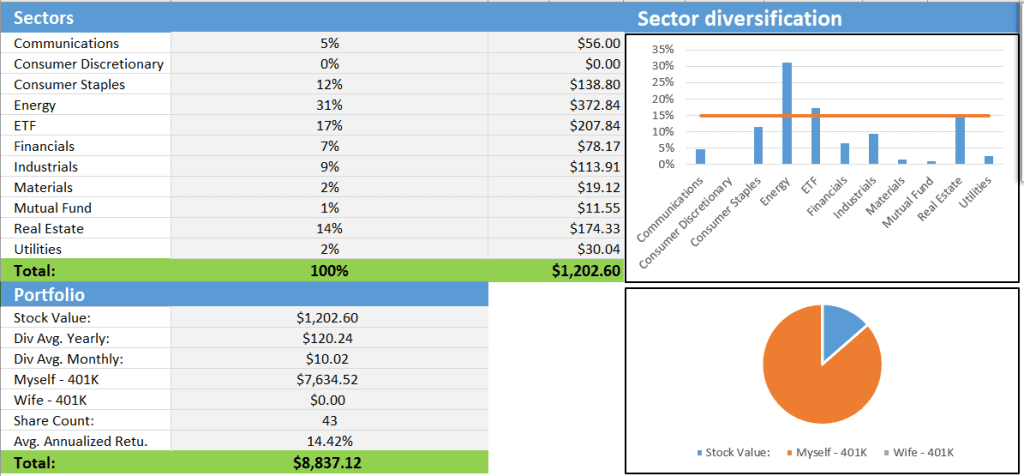

Here is a look at my portfolio right now. I am heavy in energy so I plan to add to my other positions to even out my portfolio. My 401k took a hit a couple years back as I needed the cash during covid so I am repairing that right now. I currently add 12% of my check to it but plan to increase this to 15%-20% by the end of the year. At least 15% by July. My wife is working now so her 401k will begin going up in 3 months so that will help add to our portfolio.

In January I added Arbor Realty Trust (ABR), Highwood Properties Inc. (HIW) and Wendy’s (WEN) to my portfolio in January. I wanted to add more to my real estate positions and I figured why not when it came to Wendy’s. I wanted more food exposure and McDonalds is a little high for me right now but I will add to them later.

Overall I think my portfolio is increasing at a good rate and I am happy with it. The goal is too have at least $12k in my stock account by the end of next year. I think this is doable. Persistence is key when it comes to this and I know I can do it.