Will Medical Properties Trust Cut Their Dividends?

Medical Properties Trust (MPW) is a medical REIT stock. MPW owns and operates 444 facilities and approximately 45,000 licensed beds in 10 countries and across 4 continents. One of their biggest selling points is their dividend payout, which sits at 14.27%. For a dividend investor this is amazing but is it too good to be true? I have been buying MPW at least once a month now and I have faith in the company. However, recent news has me worried that MPW might cut their dividend payments.

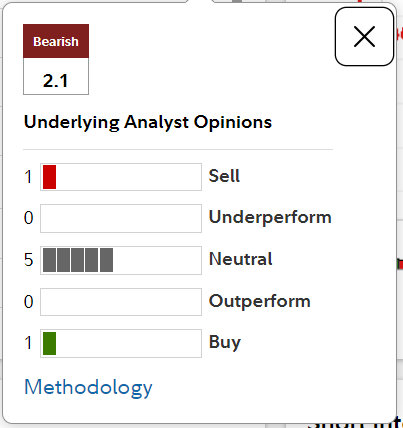

MPW released their second quarter update on Tuesday and investors became rattled by it. The share price plunged 14%. This has been leading some analysts to believe the REIT might cut their dividends. From what I have researched, investors are concerned that MPW did not declare their dividends in its Q2 update. Its most recent dividend payout was back in July and there should be another scheduled for September/October range but the company has yet to reveal it.

Will they cut their dividends?

That is a tough one to answer, especially when you consider MPW’s CFO Steven Hammer said (saying it without saying it, “everything is on the table.” I myself do not think investors should be worried about Medical Properties Trust. Even though they did not declare a dividend payout in Q2, if you look back their history, you will see they do not announce dividends until mid-to-late August. I saw wait until the end of August and see if they announce, and if they do not I would begin to worry a little.

As for the CFO’s, comment that, “everything was on the table,” it is important to note the context of it. Going back to February 2023, during a quarterly conference call, MPW’s board of directors evaluated all liquidity alternatives. The company paid dividends twice since then without any cuts.

Good news

Despite concerns over their dividend payouts, I believe MPW will give us good news. In addition, even if the company reduced their dividends, I think the payout percentage would still be attractive and worth investing in. A dividend reduction would actually benefit the company and reduce their debt leverage.

I am optimistic though and believe that Medical Properties Trust will keep dividends at current levels. Right now, the company is focusing on collecting 50% of the rent on PHP’s California facilities in September with 100% being collected by March 2024.

Should I still invest?

That is a question only you can answer. For myself, I plan to wait until the end of August to see where the company is at and make a decision then. However, if I see stock prices fall to around $5-$6 a share, I will buy more. Even if dividends are reduced or cut all together, the company’s stock price will climb back up to $14. So investing now on the low end makes sense.