Emergency Fund: Your Safety Net for Life’s Surprises

Life loves to throw curveballs. It is an equal opportunist in messing things up. You never know what will happen tomorrow, next week, next year, or 10 years from now. People love to assume that everything will be ok and nothing bad will ever happen to them. If only life was actually like that, that would be lovely. However, life does not work that way. Far too often we find ourselves in situations where money is the main problem. Lacking the financial means to resolve the situation only compounds the issue.

Having an emergency fund is crucial for long-term success. Whether you are single, married or you have a family with people that count on you, having an emergency fund can shield you from hardship. If you have a family, why would you leave yourself and them in a situation that would cause unneeded stress? Imagine having a newborn that requires formula and a major event happens that requires a large amount of money and you have no way of taking care of that and providing for your child? An emergency fund would solve this problem for you. I will have real life examples near the end of the article, it will be worth the read.

Our Sponsor

Visit our friend to learn about What Credit Score is Needed for Credit Care

What is an Emergency Fund?

An emergency fund is a stash of cash set aside for unexpected events. Think of it as a financial cushion that can help you out when life throws a curveball. Whether it’s a car breakdown, medical bills, or a job loss, having this fund allows you to cover these expenses without going into debt. The key here is to have enough saved up to handle at least 6 months’ worth of living expenses. Some people will say 3 to 6 months, but in today’s world, anything less than 6 months is not realistic. If you have a family, possibly 8 months’ worth might be required.

To calculate what you need for an emergency fund you do the following;

- Rent/mortgage + utilities + food + gas + miscellaneous x 6 months. Once you have this amount calculated, I like to round up, even if its $2 over, I am rounding up a full thousand.

- A quick google search shows the average expenses for a family of 4 is roughly $7,400 per month. This figure covers mortgage, food, health insurance, etc. Using this example, you would get $44,400 for 6 months and if you add the round up, you will end up needing $45,000 for 6 months. This would be a good start to secure your future. Most people do not realize how much they need for an emergency fund until they do this calculation. Do you have enough to support your family if you lose your job? I am realist and I would suggest that if you have a family, saving up for 8 months instead of 6.

Benefits of Having an Emergency Fund

- Protects Against Financial Stress

- Ever had a day where everything seems to go wrong? Imagine your car breaks down on the way to work. Not having an emergency fund makes this situation way more stressful. You might worry about how you’ll pay for repairs or whether you’ll be late and lose your job. An emergency fund lets you handle these surprises calmly and confidently. Remember, if you rely on this car to get to work and suddenly you cannot use it anymore, how will you keep your job?

- Keeps You out of Debt

- When unexpected costs arise, many people turn to credit cards or loans. But this can lead to a cycle of debt that’s hard to escape. Using the example above, if you did not have an emergency fund, you would be forced to take a loan out to fix your car.

- Provides Peace of Mind

- Having an emergency fund is like a warm blanket on a chilly night. It gives you comfort knowing you have money set aside for emergencies. This peace of mind can help you focus on other areas of your life, like your job or spending time with family, without the nagging worry of financial instability.

How to Build Your Emergency Fund

- Start Small and Stay Consistent

- Building an emergency fund doesn’t have to be overwhelming. Start by saving a small amount each month. Even $25 can add up quickly. It’s like filling a jar with coins; every little bit helps! The point is to start the process and never look back!

- Set Clear Goals

- Having a specific target can boost your motivation. Decide how much you want to save and by when. For example, if you aim to save $3,000 in a year, you’ll need to save about $250 a month. When you hit that goal, it feels fantastic! You can also set mini goals to help boost your confidence and motivation. For example, set a goal of saving $200, then $500, then $750, then $1,000, then $2,500, etc. These little goals will fill you with Dopamine. This is the feel good chemical your brain produces when something good happens. Use that feeling to push forward and secure your future.

Where to Keep Your Emergency Fund

- High-Yield Savings Account

- Once you start saving, you’ll want to put your money in a safe place where it can grow. A high-yield savings account, or HYSA, is a great option. It earns interest while being easily accessible when you need it. It’s like planting a tree that bears fruit when you need a snack later!

- Most HYSA have high interest rates such as 3% to 5%. If you are going to park your money for a rainy day, it might as well earn you money in return.

Real Life Examples

I can write an article and spew facts at you over and over but will it really hit home for you? Will this article change your perspective on financial planning and push you to begin an emergency fund? It might, but it might not. There are a lot of people who will read something life changing and never change a thing about their life. Maybe this story will do that for you.

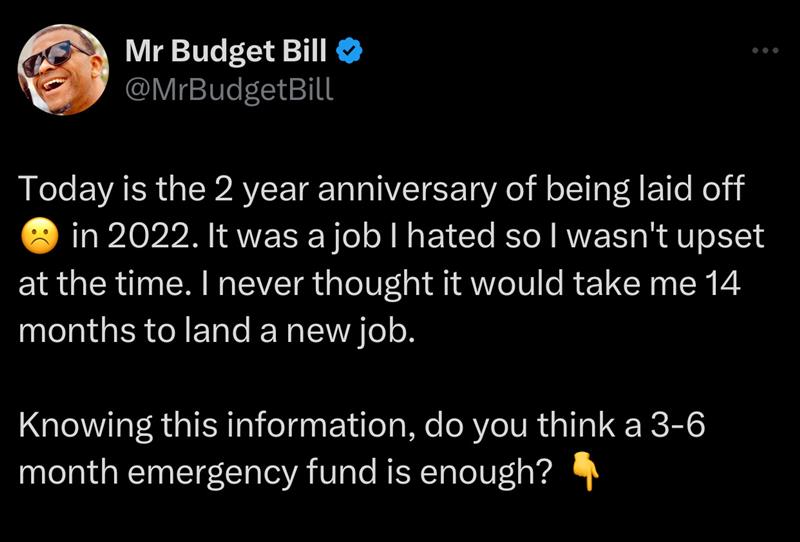

My buddy Trell on X went through a situation like this. He was laid off for 14 months. Imagine being in this situation, wondering how you will pay your bills, how you will eat. You are probably saying, “You said 6 months would be enough!” No, I said it would be a good start. 6 months will help you stay afloat, especially if you budget and remain frugal during this dark time.

Trell luckily had plenty of money saved and had 4 rental properties, Youtube, and side hustles to help him stay afloat. However, having that safety net is not a guarantee either. As I said above, life loves to throw curveballs. He had 1 eviction and had to do repairs on one of the units which took from his emergency fund. The property required a full rehab. Lady smoked in the house and dog ruined laminate floors. So it was a full rehab. Converted into AirBnB while unemployed. He took a major risk but it paid off.

I am happy to say Trell made it through and was able to secure another job. He said what helped him is having over a year in funds and having zero interest credit cards he could use to make repairs and pay off little by little. He had a happy ending but could you imagine if Trell did not have a year’s worth of funding? If he did not have those rental properties? What if his layoff happened when he had a few hundred bucks to his name, things could have been different for him. Taking charge of his finances helped him secure his future.

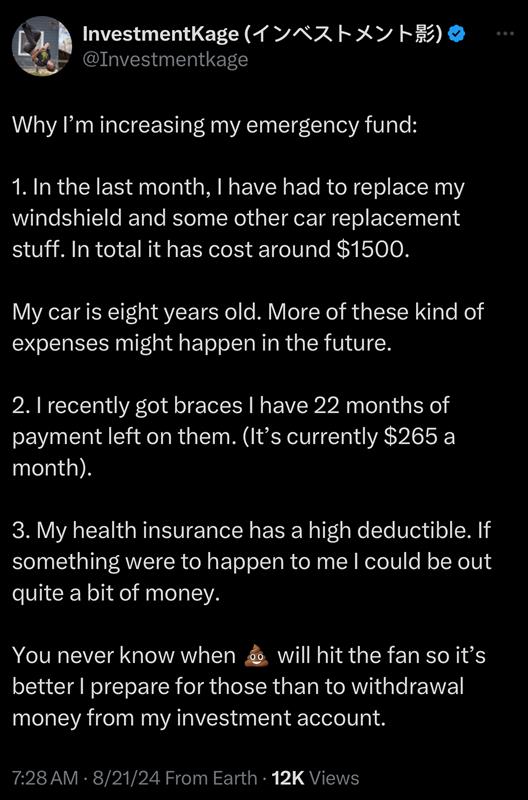

Here is another good example from my buddy Kage. He had one thing after another hit him financially. Replacing a windshield is not cheap, in his case he had to spend $1,500 to fix it. Earlier in the year he had gotten braces which he is proud of, however, he has to pay monthly for them. And as we all know, health and dental insurance is not cheap. You pay an exorbitant amount each month and still have to cover medical expenses that the insurance company does not cover or will not cover 100%.

Before all this happened, Kage had 6-months of savings which he attributed to him being able to weather these financial burdens. I asked him what he thought was an acceptable amount of months to have saved up in funds, he told me it depends on the circumstance. I can understand his point as he mentioned that some people have income that fluctuates so how do you gauge what you will need? Focusing on what your expenses are can help determine this. Kage told me he can keep his monthly expenses down to $1,500 a month, so using that number we can calculate that he would need at minimum, $9,000 for 6 months of an emergency fund. I like to round up, so I would suggest $10,000. However, if you have a family and people that depend on you, you might want to have at least 8 months to a year in emergency funds.

However, Kage lives a frugal life so he is able to maintain that number and invest heavily into stocks and save up for a house. This will not be the case for most people as with the current economic climate, expenses are rising and cost of living is rising, yet income is not. If you are able to live like Kage, I would highly suggest you do it for a year or two. This can help you save and invest a large amount of money that you can use to secure your future as well as remove any debt you might have. Kage told me his Frugal lifestyle on year helped him invest $35,000. That is an astounding number.

Act Now!

This is why you need to act now and never look back. Begin saving what you can till you hit your goals. Remove any debt you have and invest as much as you can. I promise, you’ll thank me later. You never know when a financial crisis will hit, or if the world will have another recession. You need to be prepared for any outcome.

Disclaimer

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial.