Dividend Investing and How Do You Do It?

If you are beginning to invest or already an avid investor but want to get into dividend, investing then this article is for you. Dividend is the payment you receive for owning a share of a company. The company makes profits and in turn give you a piece of that profit. This kind of investing is very good if you want something for your retirement. This is my strategy alongside my 401(k) account. My goal is to retire by age 55, I am 33 now. My plan is to stuff my 401k account with as much money as I can while investing in dividend stocks.

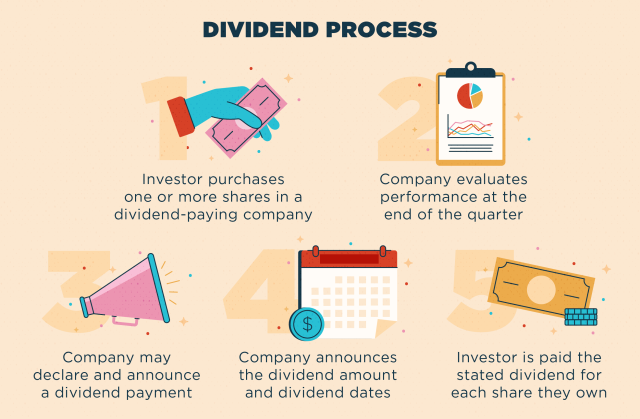

Dividend Process

The process is straight forward. You the investor will buy a share of a company. You must buy it before the declare date (Explained below.) From here, the company will gather its earnings reports and calculate what their profits were for that quarter. From there they will pay out the dividend percentage that they are offering. Some companies have a fixed dividend rate that never changes while others will vary depending on their price. The ones that vary tend to be more profitable for you as the investor but also come with more risk. These companies could have their percentage drop or drop their dividends altogether. However, companies that offer a fixed dividend rate will be the more stable companies that know they can provide this and only provide what they know they can afford to pay you.

This means you need to invest based on what your strategy is and risk level. Myself, I have a moderately aggressive portfolio meaning I am willing to accept losses because the benefit for me outweighs the risk. This is something you need to consider before investing and figure out what your risk level is and if you are ok with it. Dividend investing is not buying and selling but rather holding and reaping the benefits of long-term income.

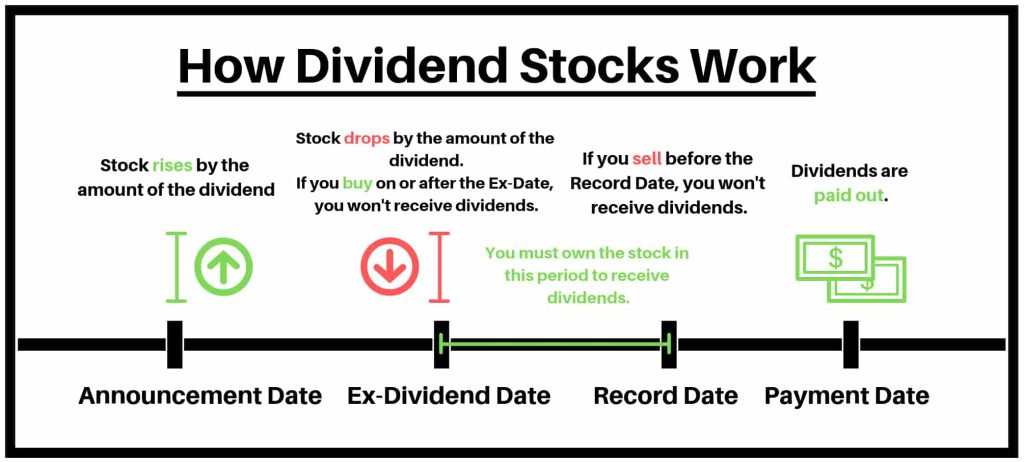

Declare Date & Buy Date

Every company that offers dividends will have a declare date and buy date. The company will have the announcement date, which they announce what their dividend payout will be. In addition, if you buy your share of the company on or after the Ex-Dividend Date, you will not receive a dividend payout for that quarter. If you sell before the record date, you will not be paid either. You must hold your shares in that company till the payment date.

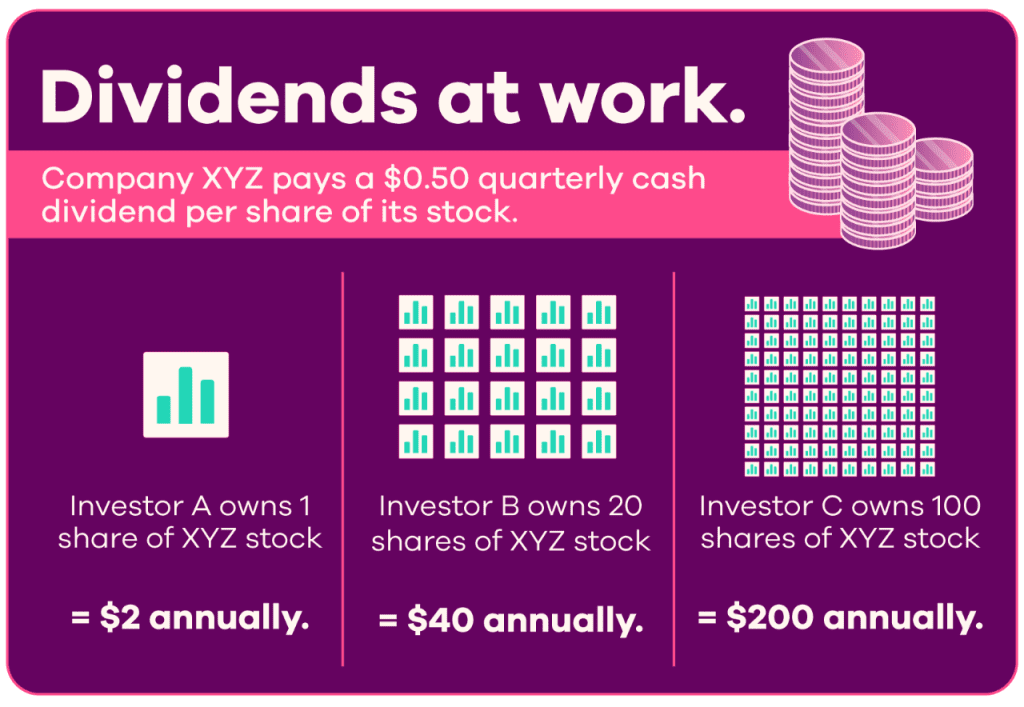

How do Payments Work?

To simplify the process even further, I will explain how you earn the dividend payout by buying a share in a company. You owning a share of a company will result in a dividend payment if that company offers that. Not all companies offer dividends so research the company beforehand. A company will pay a dividend every quarter. Like the example in the image above, if you own a share and it pays $0.50 per quarter, you can expect $2 total for the year. The more shares you own, the more dividend income you will receive. My goal is to earn enough to get roughly $3,000 to $4,000 per month. Couple this with my retirement income from my 401(k) account and I am set for life and so will my children.

Worth it?

I believe dividend investing is the best way to invest. You do not have to watch screens all day and buy and sell at the right time to make a small profit each day. Dividend investing is simply and easy for the most part. If you research a company well and understand the risk, you can buy shares and forget about them. I check on the companies on my list once every month to make sure they are progressing how I want. I spend a few hours each month doing this and it is easy to do. I do not suggest investing in 30+ companies and would suggest keeping your list under 20. This will make it easier to manage.